No products in the cart.

Events occur throughout life, and some events have greater importance than others. When considering possible future events, there are several questions you may wish to answer.

- What is the probability of this event occurring?

- When in life is this event most likely to occur?

- What impact will this event have on my life?

- Is this a positive or negative event or a turning point?

Below is a list of common events that often occur during specific life stages. These may help you as you plan for the next stage in your life. At the same time, consider events that may occur in the lives of your parents and your children, as what happens in their lives may impact your life as well.

Being a Student

Life Events – Being a Student

Growing your Allowance (Pocket Money)

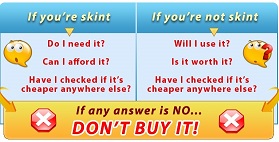

As a student, you most likely receive an allowance or earn some income of your own. There are days when you feel like your money is not enough or is in shortage. If you cannot ask for an increase in allowance, you need to get smarter to stretch your money.

Make your allowance go further by differentiating your needs from your wants: Needs are goods and services you require in your life and they are essential. Wants are those things you desire – they could also be more expensive substitutes for your needs or just non-essential.

Few examples of Needs and Wants

| Needs | Wants | |||||||||||

|

|

Make a budget to control your spending. List out all the things you need to spend money on and how much each item costs. Ideally, you should start by setting aside some money for savings. You never know when the savings will come in handy. With your budget, you should find yourself less likely to be cash-strapped in paying for your needs. If there is any money left, you could spend a little on yourself and save the rest.

Few Tips…

- Ask for “combos” when visiting a restaurant and make use of student offers and discounts

- Subscribe to mobile phone plans specially catered for students like you.

- Use the concession pass issued to you for travelling between home and school / college to enjoy concessionary rates on public transport.

Financial Assistance for Students

- Many companies and organizations offer scholarships for students who excel in their academic studies and / or co-curricular activities.

- Your educational institution may have a bond-free scholarship scheme in place to recognize your hard work.

- Some banks offer Tuition Fee loans which are interest-free during your course of study.

Starting Work

Life Events – Starting Work

As you transit from student life into workforce, most of you will become financially self-reliant. These are exciting times – who wouldn’t feel a sense of elation when we see our first salary being credited into our bank account? But few of us can afford to spend our money without care. Some of us may have responsibilities like dependents commitments, repayment of loans, etc. Even after landing your dream job, or dream income, you can still land yourself in trouble in the absence of money management skills.

Control Spending and Credit Usage

It is quite natural to expect reward for hard work, but do keep this in perspective. If the latest must-have designer bag or IT gadget takes up a generous chunk of your monthly income, maybe you should rethink the concept of reward. Little self-control and a strong urge to splurge, can only spell trouble in the longer run.

You applied for a credit card, visited posh restaurants, dressed only in the best labels, bought a new car with a loan. Everything looked rosy, but started to feel the pinch as you couldn’t always pay the credit card bills in full on time. You started to pay only the minimum sum, and also took cash advances and borrowings from parents. Finally, the car was repossessed and you sought help to restructure your debts to avoid bankruptcy..”

As the old saying goes, always spend within your means. Think twice before you borrow. Getting a loan or credit line should only be only a last resort.

Managing your Income

Identify your disposable income (i.e. salary left after paying taxes and EPF, rent or contribution for your share of household expenses), and make sure your monthly expenditure does not exceed what is left of your income.

Identify your disposable income (i.e. salary left after paying taxes and EPF, rent or contribution for your share of household expenses), and make sure your monthly expenditure does not exceed what is left of your income.

Learn to make a Budget

A practical way of managing your disposable income and monitoring your expenditure is to draw up a budget. A simple one can be planned in just three steps:

- List all your daily living expenses (transport, meals and rent / contribution to household expenses, etc.)

- Decide how much of your salary to spend on each item and stick to it strictly

- Set aside the rest of your pay and save it. Start with Rs.1000 per month and aim to work towards at least 10% of your pay. You can save more is possible.

Do remember to review your budget every now and then. If you need assistance, use an online budget calculator. Adjust the differences accordingly – allocate more money to prioritized items, cut unnecessary costs and make sure you save the remaining amounts. Save small amounts as it can build up over time with the help of compounding. Set aside 3 to 6 months living expenses as savings for unexpected expenditure and rainy days. Remember to set aside some money for occasional expenses like a birthday present or a wedding gift. Don’t be too discouraged if you cannot stick to your budget. Motivate yourself to try harder next month by keeping your financial goals in mind.

Planning Ahead

Do make an effort to learn and apply basic money management skills. Develop a financial plan setting goals as well as action steps to achieve them. Learn how disciplined savings and investing can reach those goals and be financially prepared with savings and insurance for emergencies. We are responsible for our own financial well-being.

Staff Benefits

Some workplaces entitle you to benefits which allow a cut down on expenses. Check with your employer if you enjoy reduced medical fees, group insurance schemes (understand benefits and limitations). Know about insurance portability and consider getting life insurance if you require financial protection for your dependants.

Getting Married

Life Events – Getting Married

Congratulations, if you are recently married or planning to get married in the near future.

Planning a Wedding

Everyone looks forward to their wedding and to the start of married life. Decide together on the amount to be set aside for organizing your wedding. Remember that this should be pegged to your income and comfortability, and not your cousin or friends spending on their weddings! Major events like weddings can be expensive and cost you high. Take charge, prioritize your requirements and manage expenses carefully. Years from now, wedding should bring back beautiful memories, and not make you feel for the amount spent or owe your lender.

When planning your wedding, be open about your expectations and means of managing your finances throughout your married life. Family members from both sides are likely to have a say in the planning process. Everyone has a dream wedding in mind and there could be strong views about ideas and traditions to be included. Be open to their suggestions but remember to take control to have the wedding you want and to avoid spending on something you do not want.

Budget

Decide together about the overall budget. It could be a very long list. Remember to include honeymoon expenses and miscellaneous costs. Keep a buffer for any unexpected costs. A lavish wedding is not necessarily more fun for everyone, especially if it leaves a severe hole in your savings. If you are considering a wedding planner, do make sure you check out their services and costs.

Start planning early and watch out for early-bird promotions.

If the dream wedding is going to cost you more than what you can afford, try to do with less. A simple wedding can still be a great wedding. Borrowing should be the last resort and consider these before taking out a loan:

Decide how much you need and can afford to repay monthly along with the time period to repay this debt.

Shop around for the lowest Effective Interest Rate (EIR) on your loan.

Planning your finances together

One essential aspect of living together is to learn how to manage your finances jointly. You and your spouse may have different attitudes towards money. Money matters can cause a strain in any relationship. Find less expensive but still meaningful ways to celebrate significant milestones in your marriage.

Few tips to deal with your money amicably:

- Know each other’s style of managing money and adapt to it. If one is a spender, agree on some limits and be a saver to complement. Make expectations for your partner clear and find some common ground.

- Make an effort to draw up budgets jointly. This will help to track how incomes are being spent and how to improve your financial position.

- Find a way to share responsibility for all household expenses as well as savings for common goals like emergency funds or retirement. Find agreement on each partner’s contribution; it may be in proportion to each person’s income.

- Set goals and take responsibility to live within your means as you won’t always be a young couple just starting out with promising careers. One of you may have to stop working one day for the sake of kids or elderly parents. Expenses will go up as family grows. Encourage each other to work towards your shared goals.

- Avoid impulsive spending or borrowing. Do not make large financial commitments without reaching consensus with your partner. Always keep within your means; as a guide, your debt to income ratio should not be more than 35%.

Get important things sorted out first – consider health & life insurance.

Buying a Home

Life Events – Buying a Home

Buying a home is probably the biggest financial commitment for most of us. It is a long-term commitment which should be carefully planned upfront. Before you start looking for a home to buy, consider your current income and expenses, available savings, as well as loan eligibility. It involves making some upfront payments, as well as monthly payments such as your housing loan instalments and conservancy charges.

ome loan

A home loan or mortgage loan is a loan to buy property. A home loan is usually repayable in monthly installments. Before taking up a home loan, make sure that you can afford the repayments. Do ask for a repayment schedule to help you to estimate monthly costs. Banks charge interest from the date the home loan is disbursed. The disbursement may be in stages if the purc hase price is to be paid progressively.

Upfront Payments

Initial deposit / Down-payment - The amount you pay in the beginning depends on the value and type of property you buy, existing housing loan, and tenure of the loan you intend to take. Also remember the incidental costs:

- Legal cost – Stamp duty on purchase

- Agent or salesperson's commission and fees (if you use their services)

- Other miscellaneous cost such as interiors, furnishing and modular kitchen.

Monthly Payments

- Housing loan repayments

- Mortgage reducing term insurance

- Conservancy charges / Management fees

- Property taxes (half-yearly)

- Utilities bill

Affordability

Make sure you buy a home that you can afford in the long run. To work out what you can afford, list the available resources to fund the upfront costs, as well as to pay ongoing monthly payments and other expenses related to owning a home.

Ongoing expenses like property taxes, mortgage insurance, conservancy and management service fees, cannot be paid out of savings. You need to set aside sufficient amount for these monthly payments, in addition to meeting your current monthly living expenses and existing financial commitments. Avoid using all your savings to finance your home. It is advisable to finish paying off your housing loan before you retire.

Your available resources could be:

- Cash savings – to meet upfront payments to buy your home and also to keep up with monthly payments in the event of income loss

- Sales proceeds (from your current home, if any)

- Your income (steady income or commission-based)

Even if you are eligible for a bigger loan, do not take it up unless you are sure you will have the resources to fund it. Remember that you must keep up with loan payments at all times, even if you lose your job, or exhaust your savings.

Borrowing Limit

Two main criteria banks use to assess your loan eligibility are:

Financial commitment-to-income ratio – Total monthly debt obligations such as existing personal loan, car loan, overdraft facilities and other credit facilities to total monthly income. This is to determine your repayment ability.

Loan-to-value (LTV) ratio – Amount of loan taken on a property in relation to its value expressed as a percentage. The maximum LTV at which banks in India may finance is 80%.

![]()

Factors that banks use to determine the LTV to be granted are:

- Use of property for owner-occupation or investment

- Existing loan (s)

- Monthly repayment installment as a proportion of gross monthly income

Monthly Payment

A home loan is usually repaid in monthly installments consisting of principal repayment and interest payment. The size of your monthly installment depends on loan amount, the tenure of loan, the interest rate home loan and method of interest computation. Do note that a longer tenure would result in smaller monthly payments but higher amount of total interest. Always ask your lender for a repayment schedule.

Like SAVINGS, Compounding will happen in INTRESTS as well.

Types of home loans

There are two main types of home loans

- Fixed-rate home loan packages – fixed rates usually apply for an initial period, thereafter followed by a floating rate

- Floating or variable rate home loan packages

There are also more complex home loan packages. Do make sure you understand the special features and whether these may be removed or amended later. Often, a promotional rate is offered for the first few years. Make sure you know how much your monthly payments will increase by when the promotional period is over.

| Computation of interest |

The two common methods of interest computations are:

|

| The total interest payable on a monthly-reducing loan is lower than the total interest payable on an annual-reducing loan. |

Meaning of Mortgage

| |

| Tips for managing your debts | |

| Here are some tips to help you to manage your debts: | |

| 1. If you are having problems with your cash flow | |

| Draw up a monthly budget which shows your monthly income and expenses. Listing out your expenses, cut out discretionary spending and keep up with debt payments. | |

| 2. Monthly debt commitments | |

| Do not allow your monthly debt commitments to exceed 35% of your gross monthly income. Review your debts regularly. Avoid multiple sources of credit. It is easier to keep track of repayments when you have fewer credit facilities. | |

| 3. Prompt payment of monthly installments | |

| Pay the installments promptly and in full to avoid interest and penalty charges. If you are unable to make payment on time or in full, inform your lender and ask for help | |

| 4. Increase your regular repayments or make lump sum repayments | |

| If you have some extra money ask your lender if you can increase the repayment amounts. This way you can pay off your debt quickly or make a lump sum repayment of your loan. But check for any penalty charges or advance notice before increasing regular payments. | |

| 5. Pay off the debt with the highest interest charge first | |

| As credit cards generally charge higher interest rates, it is best to pay the bills on time. At the same time, cut back on credit card spending. The faster you reduce your outstanding balance, the less interest you may pay. If you have multiple debts, consider refinancing or consolidating by transferring all the balances to a package with lower rate of interest. |

| Consequences of Non-payment | |

|

Refinancing and Repricing

Refinancing is about switching to a new home loan with lower interest rates either with your existing bank or another lender. Refinancing at your existing bank is called re-pricing or conversion. Review your home loan regularly to see if you can save money by refinancing. Ask your existing bank for re-pricing options, but check with them whether the lock-in period still applies to your loan. If so, certain penalties may apply.

Having Children

Life Events – Having Children

Thinking of having your first child but concerned about the additional costs? Do not let financial considerations prevent you from enjoying one of the pleasures the life has to offer- starting a family and parenthood! | ||

Managing the costs of having a child – With a new addition to the family, you and your spouse may need to adjust your budget and financial plans. Consider taking out health insurance for your child and life insurance for self to protect your family after your life. Paying for your children’s education – Most parents want to provide education for their children. But the cost of this can be hefty – it includes not just the school or tuition fees but also their living expenses. It can be frightening if you do not prepare or plan ahead. | ||

| Some useful suggestions to help you to get started: | ||

| ||

| Plan your Expenses: | ||

| College, University and Marriage expenses can be really large and should be planned. Regular Expenses for the child should be managed through your regular annual family income. |

Buying a Car

Life Events – Buying a Car | ||

| Owning a car may involve a “high maintenance” cost. Before you decide to buy a car, consider if public transport can meet most of your transportation or commuting needs. Try adding up the cost of each journey made by your family members every day and compare this to the cost of owning and running a car. Owning a car may not be a better option. | ||

| How much does it cost? | ||

Buying a car can be expensive, especially if it is a luxury or prestige car. If you need to sell your car later, it will be at a value lower than its original purchase price. The price you receive may not be enough to pay off your car loan. There are also running costs such as fuel expenses, road tax, servicing and repair costs and motor insurance premiums. | ||

| Borrowing to pay for the car | ||

| Most of us may not have enough cash to buy a car without borrowing money. If you are going to borrow, work out your affordability first. In addition to meeting your current household expenses, debt and other financial obligations, you will be adding to your expenses and still need money for the upfront payments to buy the car as well as to run it. | ||

| Work out how much money you need for each item, and decide if your budget is able to accommodate these expenses. As a rule of thumb, your total debt repayments should not exceed 35% of your monthly income. | ||

| Car financing | ||

| ||

| Motor Insurance | ||

|

Becoming an entrepreneur

Life Events – Becoming an entrepreneur | ||

To become an entrepreneur and launch a business is critical. Financial considerations are crucial in ensuring that you have the capability to pay your bills and expenses associated with a business launch throughout the startup period. | ||

| Few essential steps include: | ||

| ||

| Some Tips and Warnings | ||

|

Losing your job

Life Events – Losing your job | ||

| ||

| Here are some ideas that may help you through the period of unemployment: | ||

| ||

These measures may seem tough at first sight, but they can help to manage your finances over this tough time. |

Death of a Breadwinner

Life Events – Death of a Breadwinner | ||

| ||

| Some suggestions to help you: | ||

| ||

|

Divorce

Life Events – Divorce | ||

Going through a divorce can be emotionally difficult. Managing financial matters on your can be tricky, especially if you were not the one handling the family’s finances in your marriage. | ||

| Things you need to do may include: | ||

| Sort out your individual finances | ||

| Take stock of any joint bank accounts with your ex-spouse and decide whether to close them. Check if you have issued a supplementary credit card to your ex-spouse, and inform the bank if you wish to cancel the cards. Make necessary arrangements for any joint loans or debts taken out or co-owned property or investments to be separated. | ||

| Paying the bills | ||

| If you have been paying household bills through a joint account, you may have to make arrangements to pay through your own account. | ||

Review your Will and other nominations

| ||

| Health and Life Insurance | ||

| If you and your children were included in your spouse’s employer group insurance scheme, these may no longer be available to you. Consider getting health insurance for yourself and your children soon and also some basic life insurance to protect your children against financial loss in the event you are no longer around. | ||

| Budgeting | ||

| Review your budget as you have to live on less income, whether you are working and / or paying or receiving maintenance. If so, adjusting your current lifestyle and watching your spending is important. If there is no budget, make one to manage your money carefully. | ||

| Emergency savings | ||

| As far as possible, do build up emergency savings. A rule of thumb is to have about 3-6 months of monthly income in emergency savings. | ||

Investments

|

Retirement

Life Events – Retirement | ||

| ||

| Start saving for your retirement | ||

| Step 1: Define your retirement goals | ||

| Ask yourself when you would like to retire and your preferred lifestyle during retirement years. Work out the amount of money required when you retire to provide for your desired lifestyle. Many financial planners would generally recommend that you should be able to draw an amount of at least two thirds of your last drawn monthly income. However, do note that the amount varies from person to person, depending on the lifestyle each person prefers. | ||

| Indians are living longer and healthier with average life expectancy higher than before. Hence when you are planning for your retirement, do take note of the number of years you expect savings to last, as you may outlive your retirement funds. | ||

| Step 2: Assess your current situation | ||

Work out the money you can expect from your savings account, PF savings, insurance policies, and other investments when you retire. Aim to pay off any outstanding loans and liabilities before retirement to minimize debt obligations during your golden years. | ||

| Step 3: Get started on your retirement savings plan | ||

| ||

| Stretching your retirement funds | ||

| During retirement, it is important to manage your funds prudently. Focus on maintaining a healthy and active lifestyle with a balance of social activities to keep occupied. Use a budget to help you keep track of your finances. This will help to track your retirement income and expenses. Your retirement income may depend on investment income and savings. If investment income is irregular in terms of amount and timing, adjust with withdrawals from bank savings to ensure sufficient income. If you have fixed deposits, do remember when to roll over the deposit and when to utilize for daily living expenses. | ||

| Use the budget to manage your spending too. If you are spending your retirement funds too quickly, find some discretionary expenses that you can reduce or cut down. | ||

Here are some tips:

| ||

| Investing for seniors | ||

| ||

| Things to consider when investing: | ||

| i) Your investment objective | ||

| The objective of investing may be to earn a regular income, preserve capital, and grow your capital or hedge against inflation. The product you are considering should achieve these objectives. Check if it complements or adds risk to your portfolio of investments. | ||

| ii) Your risk affordability | ||

| Know your risk profile well. You may be a “conservative” investor who cannot afford to lose capital or can afford the possibility of losses that come with products that offer higher returns. If retirement savings are less do not take too much risk when you invest. There is no luxury of time to earn back what you might lose if an investment turns bad. | ||

| iii) Your investment time horizon i.e. time period to invest to achieve financial goals | ||

Generally, the shorter your time horizon, the less risk you should take with your investments. If you are likely to need access to your money at short notice, invest in products that can be liquidated easily or will not impose penalty charges for early withdrawal. | ||

| iv) Your responsibilities and rights for investing | ||

| If you are an experienced investor, you probably know what to avoid. | ||

| Do not invest in “hot picks” or “trendy stocks” just because others are buying them. Read and understand about the investment and the risks involved. Make sure you’re comfortable with the risk and returns before you invest. | ||

| Do not invest in products you do not understand or find unsuitable. Find out how returns are generated, the risks involved, critical terms and conditions and fees and charges which would reduce your returns. Do not be enticed by gifts and promotions or promises of high returns. Always remember that the higher the returns promised, the higher the risks you may have to bear. | ||

| v) Monitor the performance of your investments regularly | ||

| Review and rebalance your investment portfolio from time to time so as to meet your investment objectives. Monitoring continues to deliver the returns you expect and meet your needs. |

Preparing for the Worst

Life Events – Preparing for the Worst | ||

Preparing for the worst in life is not just about having adequate life insurance. It is also about arranging financial matters clearly while you’re still around so that your loved ones will not have to trace your assets and monies. Leaving clear directions about estate distribution should also ensure that your estate is smoothly handed over to your loved ones. | ||

| Estate Planning | ||

| Estate planning is about how you distribute your estate (the money and savings) according to your wishes after your death. It is about making sure that the people or causes you care about receive some of your estate in the amount and manner you wish. | ||

| Mean of Will | ||

| A Will spells out exactly how you wish to distribute your movable assets (e.g. bank deposits and insurance policies) and your immovable assets (e.g. flat, apartment, shop units or house) among the people or causes and charities you want to inherit these (your beneficiaries). | ||

| ||

| Absence of a Will… | ||

| Your money may not reach the people who you feel truly need it the most. For example if your spouse and children are financially self-reliant, you might have wanted to provide for your elderly parents, disabled or unemployed siblings, your grandchildren or even your grandparents. | ||

| A Will can help to prevent unnecessary complications after your life. |